![]()

"My grandson has a child's savings account at Y-12 FCU. I like that his account will grow with him. The account will help teach him money savings and spending as he grows."

- Theresa

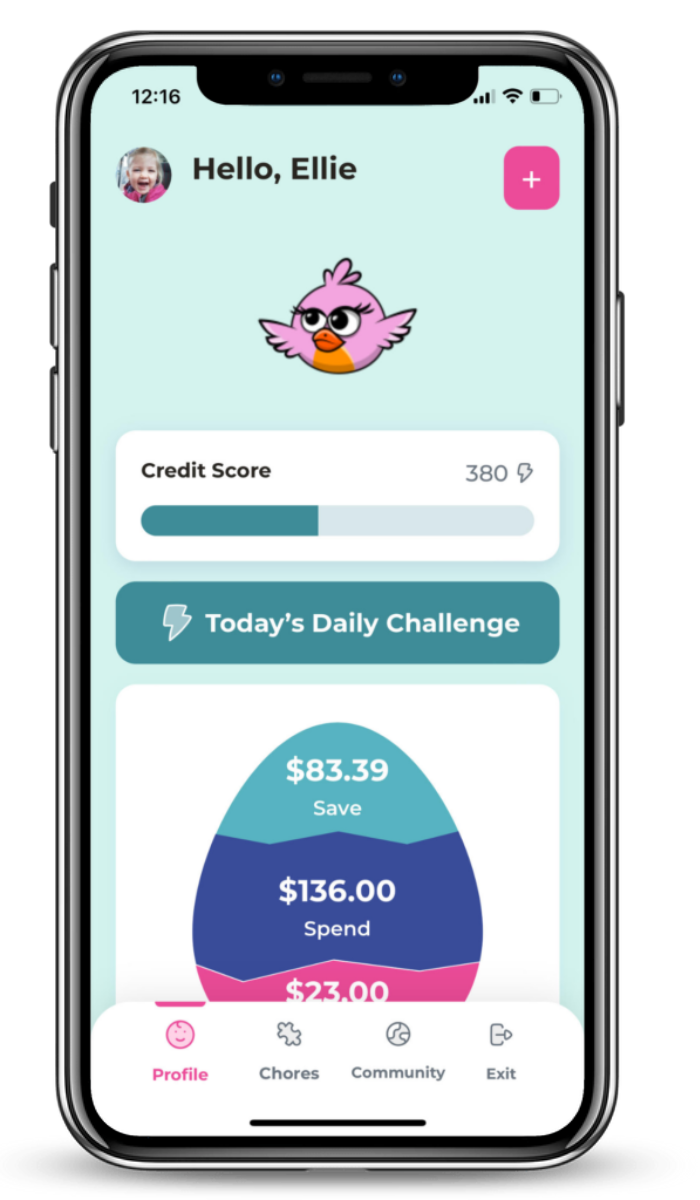

GREENLIGHT DEBIT CARD & APP

The debit card for kids. Managed by parents.

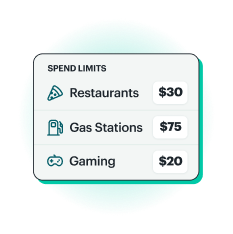

Free3 for members, Greenlight is the award-winning money app loved and trusted by 6+ million parents and kids. With their own debit card, kids and teens learn to manage money while parents send money, get real-time notifications, and set flexible controls.

What you get with Greenlight.

A debit card of their own

A debit card of their own Money management

Money management

Build life-long money skills.

FREQUENTLY ASKED QUESTIONS

We've got answers.

My First Nest Egg is a free money education app for parents and kids with a virtual tracker, learning games, goal setting, and more!

Download My First Nest Egg from your app store and use access code Y12CU to start.

RESOURCES

Need additional help?

1. APY is Annual Percentage Yield. A Jump Start Savings account is for ages 0 to 17 only. The child must be accompanied by a parent or legal guardian to open an account who will sign as a joint-account owner. The account balance will be automatically transferred to a Young Adult Savings account when the member reaches age 18. A Jump Start Savings account 2.00% APY is for the first $5,000. A balance of $5,000.01 and more earns the regular share savings rate of 0.05% APY. Dividends calculated daily, compounded/posted quarterly. Rates effective as of 01/01/2026. Rates subject to change.

2. APY is Annual Percentage Yield. A High Yield Checking (requirements waived) account is for ages 14 to 23 only. Normal High Yield Checking account fees and requirements will be effective at age 24. Rates effective as of 01/01/2026. Rates subject to change after account is opened. Fees may reduce earnings.

3. Y-12 Federal Credit Union members are eligible for the Greenlight SELECT plan at no cost when they connect their Y-12 Federal Credit Union account as the Greenlight funding source for the entirety of the promotion. Subject to minimum balance requirements and identity verification. Upgrades will result in additional fees. Upon termination of promotion, customers will be responsible for associated monthly fees. See terms for details. Offer ends 12/04/2028. Offer subject to change and partner participation.